Government Contracting 101

Market intelligence, if you are not already familiar, is a tool that government contractors use to ensure they are finding all available government opportunities, including pre-forecasted RFPs and solicitations, as well as review previously awarded contracts. In addition, many of these tools offer unique methods to for government contractors to disseminate this vast array of data, making it useable and, most importantly, actionable. Market intelligence platforms are typically provided via a software-as-a-service (SaaS) package, where a user or team of users will purchase a set number of seats (user licenses) for a given period of time, often a year. You may be familiar with this model if you have used Salesforce CRM or Microsoft Office 365.

This review site will share an overview assessment of the currently available SaaS federal market intelligence platforms currently available for government contracting. The expressed opinions are of actual paid or trial users of the below mentioned services. We encourage you to share your own personal experiences with government market intelligence platforms as well. Submit your personal responses to [email protected] and future updates will be posted as community input. Federal-Contracting.com reserves the right to not publish user reviews that it determines to be overtly defamatory, so please keep the criticism constructive!

Listed below are overall ratings based on the following criteria:

- Longevity & market acceptance

- Platform pricing & overall value

- Features & functionality

- User Interface & Ease of Use

Bloomberg Gov

Bloomberg released the Bloomberg Gov Platform (sometimes referred to as BGov) in early 2010. Bloomberg Gov is focused on users interested in the federal policy environment and congressional direction to follow the projected funding. State and local information is not currently included. The current plan offerings start at $7,500 annually per user license. Note that this platform is the only one being reviewed which bases its pricing model entirely on user seats, so an average business development team of three users can expect to pay just under $22,500/year for this service.

BGov has added labor pricing since this article was written, however does not currently have a proposal management platform as of this writing. It is a It has been reported that Bloomberg has a number of former Input/GovWin personnel which has helped them quickly establish the platform as a viable market intelligence choice for government contractors. The unique advantage that Bloomberg offers is major reporting updates regarding any subject matter that a user may want to search that could impact their directed focus for upcoming contracts.

BGov Opportunity Search

Current BGov Rating:

![]()

![]()

![]()

![]() 3.5/5

3.5/5

EZGovOpps

This Federal market intelligence tool is one of the newest entries in the space, released in 2009. It is apparent that EZGovOpps has recognized some of the strengths and weaknesses of the other available platforms and implemented some unique solutions for its users. Having the lowest price point of the platforms reviewed here gives EZGovOpps a distinct advantage. A single user license with EZGovOpps, albeit with limited functionality, is priced at roughly $2,700 annually. We don’t recommend this option as users will not have access to necessary data for competitive bids.

The higher level “Gold” plan ($4,700 annually for up to 3 users) and Platinum Plan ($6,000 for up to 6 users), which rivals the considerably more expensive GovWin platform in many aspects, actually possesses some additional functionality not found in other tools, such as an integrated proposal management and teaming platform. We also note there this analyst information for nearly all opportunities.

Also found in the higher level plans, in addition to the basic contracts, re-competes, etc. is subcontract data, enhanced company profile information, behavior analysis of buyers so users can target buyers in their NAICS/PSC codes, Schedule labor pricing rates, intel on programs, GWACs, and schedules. In addition there is a PWin matrix, program officer contact info, and org charts which aren’t typically offered in this pricepoint, if at all. State and local data is not included, so SLED users will need to expect to pay an additional $995. If you are in need of a competitive information and a robust feature set this is a hard way to go wrong.

EZGovOpps Task Order Database Management Tool

Current EZGovOpps Rating:

![]()

![]()

![]()

![]()

![]() 4.5/5

4.5/5

GovSpend (previously FedMine)

Fedmine was released a little more than 15 years ago and is considered one of the early pioneers of federal market intelligence. Govspend and Fedmine have merged and while the front end sites are different, the platform behind it is the same. Users felt that Fedmine’s platform could benefit from a refresh, which has happened with the GovSpend merger. We felt that the interface was very good but not always intuitive. On the plus side, Fedmine is an excellent service if you are a parts-based firm selling fixed amounts of parts/goods as purchase orders to the federal government.

Several attributes such as; subcontracts, labor pricing, a proposal management platform, CRM and specific intel on programs, GWAC’s and Schedules etc. are not present in this platform. We did not see any readily available analyst data populating the site either. Pricing starts at approximately $4,000 annually which does not include enhanced options. SLED (state and local) is available in higher-level packages, and depending on needs can reach $9,000 or more.

GovSpend Purchase Order Details

Current GovSpend Rating:

![]()

![]()

![]() 2.5/5

2.5/5

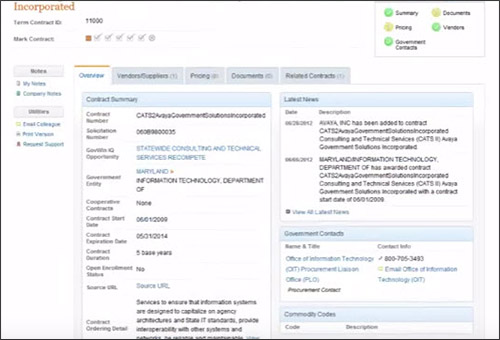

GovWin

Deltek GovWin is recognized as the current industry leader of government market intelligence. With over 30 years in the space and the acquisition of several competing companies (FedSources and Centurion Research) over the past several years, dominance of the federal market intelligence space has been their strategic focus. With the Deltek CostPoint accounting platforms being a major player for the initial majority of government contractors, it paved the way for Input, and now GovWin, to rapidly co-brand its position as the platform of choice for successful contractors. With GovWin offering many plans involving federal, state and local contract opportunities, it quickly became recognized as the leader in the government market intelligence arena.

Some of the unique attributes of the GovWin market intelligence platform involve the ability to utilize not only prime contract data and the historical analysis of pre-forecasted RFPs, but the ability to incorporate subcontract data as part of the analysis. Intelligence on programs and labor pricing are available, however are not included in base pricing. In addition, GovWin offers CRM connectivity for data extract. Third party state and local data is also provided within Govwin at an additional cost.

The largest hurdle for many users of GovWin is the cost of entry. At the time of this writing, the base pricing excludes subcontract data, task order level intelligence, labor pricing, CRM, connectivity to your existing CRM tool, and proposal management modules. The price point of roughly $7,000 – $12,000 for a bare bones deployment for lower revenue contractors to get started with GovWin (and $25,000-45,000 for mid-sized businesses) can present a significant cost barrier. If many of the options noted above are needed for a team of 5 users, pricing can reach over $30,000 annually. The GovWin platform is the only service being reviewed that appears to price its product based on the revenue of the contractor, as GovWin users with similar plans but significantly different revenue reported varying differences in their purchase price.

Deltek GovWin Opportunity View

Current Govwin Rating:

![]()

![]()

![]()

![]()

![]() 5/5

5/5

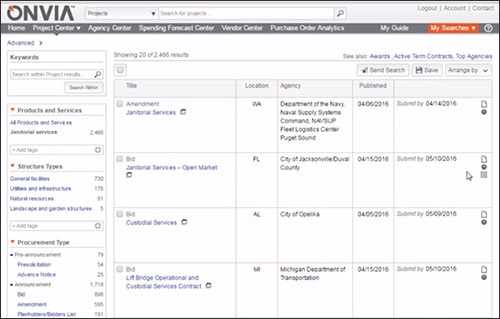

Onvia

The Onvia platform provides data coverage for federal as well as state and local. Although considered not as strong of a provider of federal market intelligence when compared to other services in this review, Onvia provides excellent coverage of state and local data opportunities. Full market intelligence analysis is truly not possible for state and local data (the data is not presented in a universal framework across states), however Onvia provides more depth than any of the other services for these opportunities. Federal market intelligence plan offerings from Onvia, excluding state and local data, run approximately $6,400 – 8,000 annually, however labor pricing, subcontract data, etc. costs additional. Many users felt that Onvia was more expensive than the current GovWin model when comparing the common attributes of each plan.

Onvia Search Results View

Current Onvia Rating:

![]()

![]()

![]()

![]() 3.5/5

3.5/5

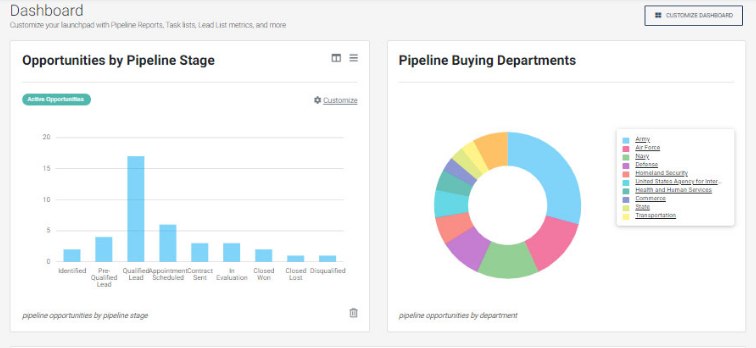

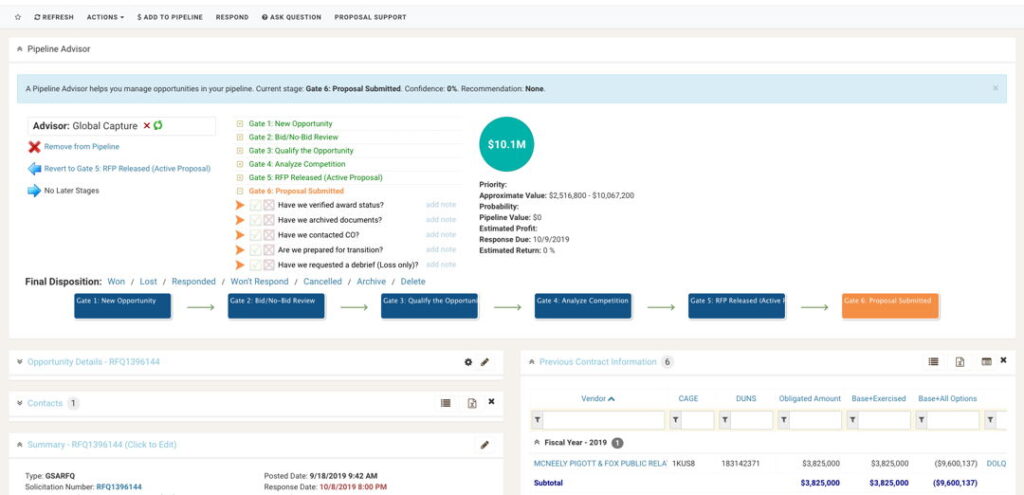

Federal Compass

Federal Compass is another platform that assists government contractors identify opportunities, perform market research, and manage a pipeline. It provides access to forecast, pre-RFP and recompete opportunities, automated searching, and team collaborating options. It is a relatively newer entry compared to the services listed above. There are analysts on staff, however analyst information seems to be less frequent or detailed as some of the other platforms. We did not notice a PWin calculation matrix, full proposal/collaboration system, or organization chart availability.

Pipeline tool and associated charts for Federal Compass

Current Federal Compass Rating:

![]()

![]()

![]()

![]() 3.5/5

3.5/5

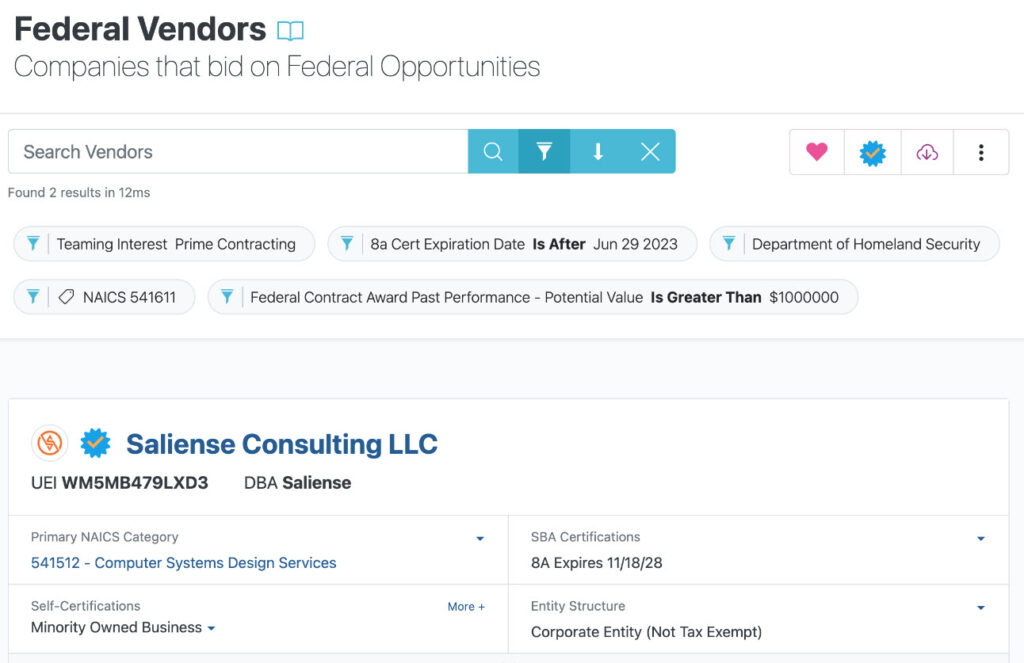

GovTribe

If you’ve ever Googled a contract number you’ve likely bumped into GovTribe. Much of the basic contract information on their site is freely accessible. GovTribe started out with a focus on mobile accessibility, so if you do more BD on the phone than your PC then you might want to check it out. We found the Govtribe site to be intuitive and easy to navigate, however it is not as robust when it comes to competitive information.

We did not see schedule-based labor pricing, org charts, or PWin calculations in this platform. Proposal management and collaboration is available however not as robust as some of the competition. We did not see any readily available analyst data populating the site either. GovTribe added state and local opportunities in 2024, however this is currently limited to 22 states. For a 5-seat license the subscription starts at $5,250.

The Govtribe Vendor Search page

Current GovTribe Rating:

![]()

![]()

![]() 3/5

3/5

Bidspeed

Bidspeed identifies as a platform to help government contractors find contracts, contacts, bids, and task orders and provides a compliance matrix to clients. It also aggregates and provides information on award data and company awards. There is access to a proprietary CRM. Cost can vary greatly and runs between ~$1,200 to $20,000 annually. Members can submit questions, however we did not see their analyst data noted on contracts/solicitations. State and Local data is available, however is limited to your selection of a few select states depending on the membership level.

We did not see schedule-based labor pricing or org charts in this platform, however a PWin matrix is included in some plans. Proposal management and collaboration is available however not as comprehensive as some of the competition.

Proposal management system within BidSpeed

Current Bidspeed Rating:

![]()

![]()

![]() 2.5/5

2.5/5

We’ve had several readers request that Federal Contracting review additional lower-cost services. These include government bid and RFP aggregators, mobile applications, and other related services. While these platforms can represent a good value, they may not be the best choice for business developers and/or BD teams that need more extensive functionality to be competitive, including human intelligence, pre-forecasting RFPS, robust pipeline management, and extensive tracking/alerts of opportunity updates. Currently we recommend concentrating your evaluation on the services listed above. Federal Market Intelligence will continue to monitor services including Bid Banana, BidSpeed, FedBidSpeed, GovernmentBids, FindRFP, GovDirections, BidOcean, BidPrime, Proxity, BidContract, and BidMatch and may choose to include in this write-up at a later time.

The ratings presented above are solely the opinion of Federal-Contracting.com based on surveyed feedback of current marketing intelligence users. Federal-Contracting.com reserves the right to update these ratings as it receives additional feedback from users of the above platforms. Last update: 7-30-2024.